Introduction

Receivables are crucial to any business, as they depict the money owed by customers for goods or services sold but not yet collected. Understanding how to find the average net receivable days is essential for businesses to analyze their cash flow, optimize working capital, and make informed financial decisions. This guide will provide a comprehensive overview of calculating average net receivables, exploring its significance and equipping you with valuable insights to enhance your financial management.

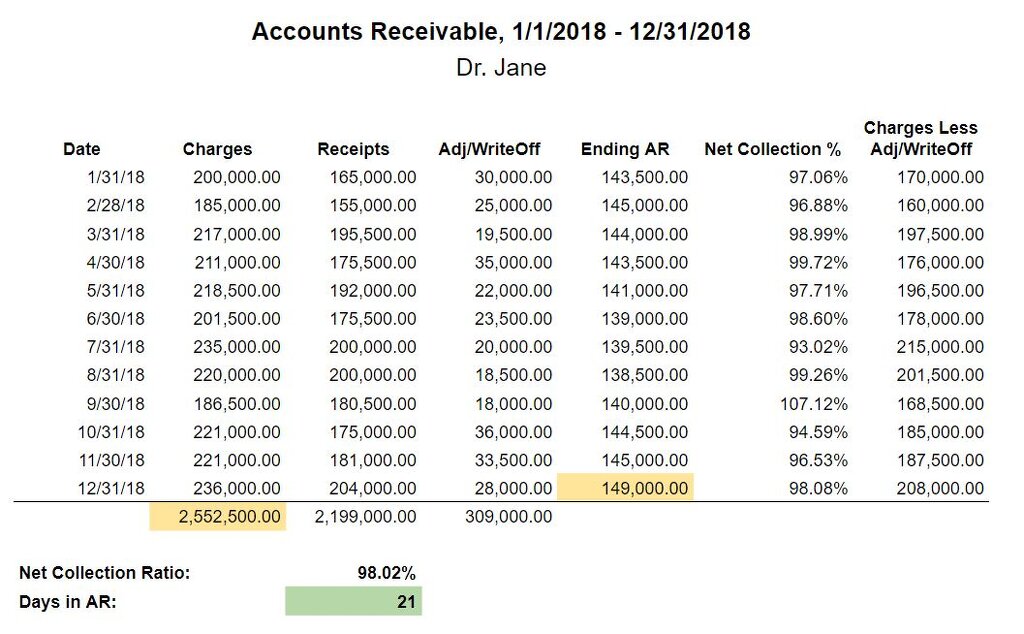

Image: www.paretolabs.com

Understanding Net Receivables

Net receivables are the total amount of money owed to a business by customers after deducting any bad debts, cash discounts, and allowances. They represent the accounts receivable minus the allowance for doubtful accounts, which provides a more accurate picture of the collectible amounts due to a company.

Formula for Calculating Net Receivables:

Net Receivables = Accounts Receivable – Allowance for Doubtful Accounts

Calculating Average Net Receivables

Average net receivables measure the average duration over which a business collects its accounts receivable. It indicates the number of days that customers take, on average, to pay their invoices. To calculate average net receivables:

Image: accounting-services.net

Formula for Calculating Average Net Receivables:

Average Net Receivables = (Net Receivables at Period End + Net Receivables at Period Beginning) / 2

Where:

- Net Receivables at Period End: Net receivables as of the most recent financial statement period

- Net Receivables at Period Beginning: Net receivables as of the previous financial statement period

Significance of Average Net Receivables

Average net receivables is a key financial metric that businesses monitor for several reasons:

- Cash Flow Analysis: It helps businesses assess the efficiency of their collection process and identify any potential cash flow issues.

- Credit Management: By tracking average net receivables, businesses can evaluate their credit policies and adjust them if necessary to minimize bad debts and improve cash flow.

- Inventory Optimization: It provides insights into the relationship between inventory levels and receivables, enabling businesses to optimize inventory levels and avoid overstocking.

Tips for Managing Average Net Receivables

There are several effective strategies businesses can implement to manage their average net receivables:

- Offer Early Payment Discounts: Incentivizing customers to pay early can reduce the average net receivables period.

- Establish Clear Credit Terms: Clear communication of payment terms and consequences for late payments can encourage timely payments.

- Optimize Billing and Invoicing: Automating billing processes and sending invoices promptly can speed up the collection process.

- Implement an Effective Collections Process: Proactively following up with customers and providing reminders can accelerate payment.

By implementing these strategies, businesses can improve their average net receivables, enhance cash flow, and optimize their financial performance.

Frequently Asked Questions (FAQs)

Q: What is the difference between accounts receivable and net receivables?

A: Accounts receivable refers to the total amount owed by customers, while net receivables is calculated after deducting allowances for bad debts and discounts, providing a more accurate representation of collectible amounts.

Q: How can businesses reduce their average net receivables period?

A: Employing early payment incentives, establishing clear credit terms, automating billing, implementing an effective collections process, and leveraging customer relationship management (CRM) systems can help shorten the average net receivables period.

How To Find Average Net Receivables

Conclusion

Understanding how to find average net receivables is essential for businesses to analyze their cash flow and financial performance effectively. By calculating average net receivables accurately and implementing effective strategies to manage it, businesses can optimize their working capital, minimize bad debts, and improve their financial health. Are you interested in learning more about average net receivables or managing your business finances? Explore our website for additional resources and insights.